Exploring Tg Wallet’s Integration with Other Platforms

관련링크

페이지 정보

작성일24-11-25 23:51 조회796회본문

The integration of financial services with communication platforms has transformed how people manage their money. By leveraging advanced tools, users can now handle transactions, track spending, and perform other financial tasks directly within their preferred messaging applications.

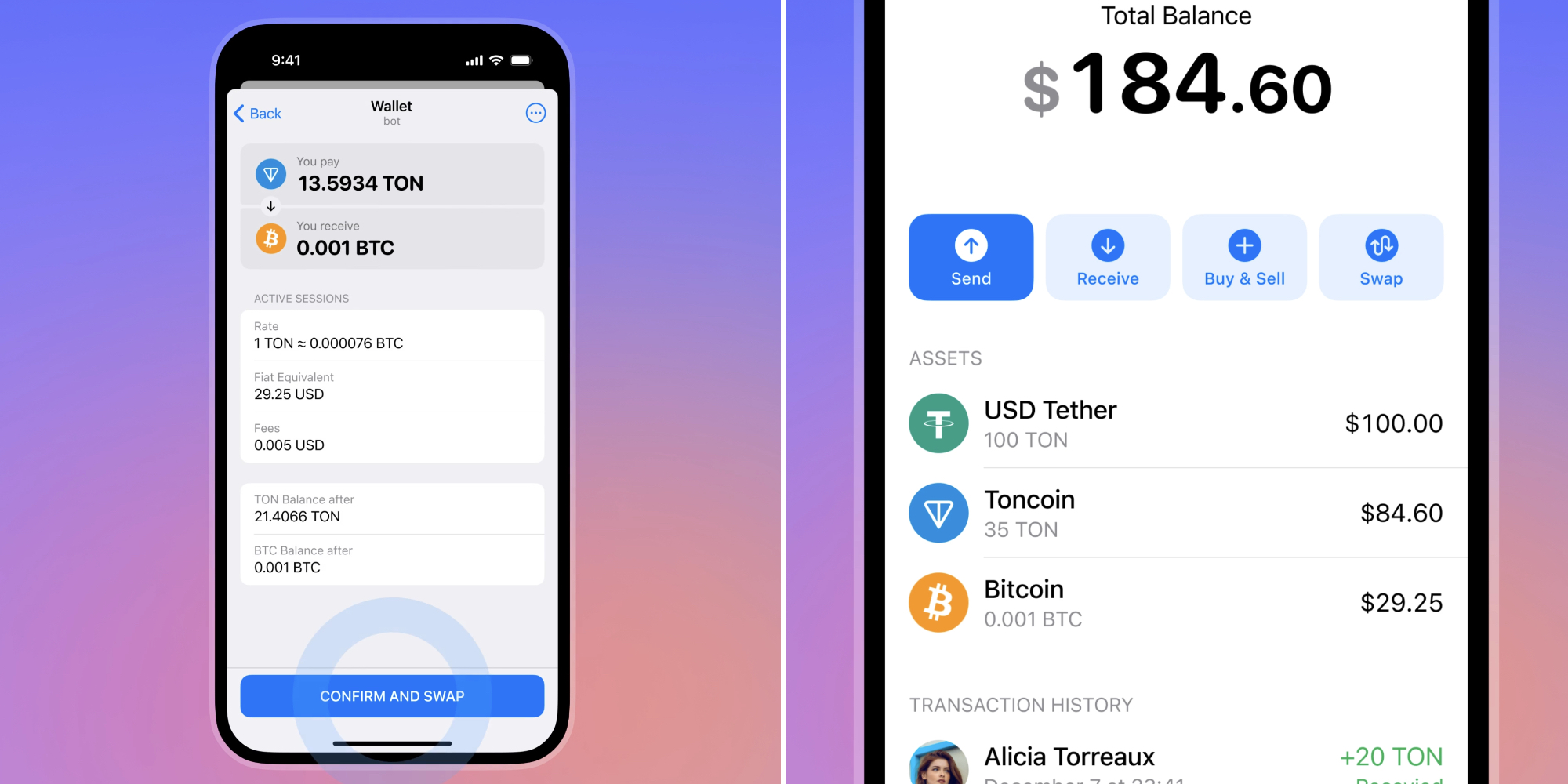

These systems offer a seamless experience, where traditional financial activities become as simple as sending a message. With features such as instant transfers and automatic tracking, users can manage their finances with minimal effort and maximum efficiency tg wallet.

Security and convenience are at the forefront of these innovations. Advanced encryption and real-time updates ensure that users' personal data and transactions remain safe while providing a smooth, easy-to-navigate experience.

Streamlining Financial Tasks with Technology

Technology has revolutionized the way we manage our finances, making everyday tasks faster and more efficient. By automating key processes, such as bill payments, fund transfers, and expense tracking, digital tools allow users to save time and reduce manual effort.

With seamless integration into various platforms, individuals can complete financial actions within a few clicks, eliminating the need for multiple applications. This accessibility not only simplifies transactions but also enhances financial organization, giving users real-time insights into their spending and balances.

Automation and convenience are key benefits of these systems. Users no longer need to remember due dates or manually track each expense, as everything is handled automatically, providing peace of mind and better control over personal finances.

Enhancing Payment Security in Digital Services

As digital transactions continue to grow, ensuring the security of payments has become a critical focus. Protecting personal and financial information during online exchanges is essential to build trust and prevent fraud.

Advanced encryption methods and secure authentication processes are being implemented to safeguard sensitive data. Features like two-factor authentication and biometric verification are now common, providing an extra layer of protection against unauthorized access.

Moreover, continuous monitoring for suspicious activity and real-time alerts allow users to be proactive in identifying potential threats. By incorporating these security measures, digital payment systems can offer users peace of mind, knowing their transactions are protected at all stages.